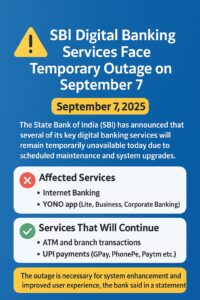

SBI Digital Banking Services Face Temporary Outage on September 7

SBI Digital Banking Services Face Temporary Outage on September 7

Report by: Syed Taskin Ahmed

New Delhi, September 7, 2025 — The State Bank of India (SBI), the country’s largest public sector lender, has announced that several of its key digital banking services will remain temporarily unavailable today due to scheduled maintenance and system upgrades.

According to an official notification, customers may face disruptions while accessing internet banking, YONO Lite, YONO Business, and Corporate Banking platforms. The bank clarified that this outage is necessary to strengthen its digital infrastructure and ensure more secure and efficient services in the future.

> “We regret the inconvenience caused to our valued customers. The downtime is essential for system enhancement and improved user experience,” the bank said in a statement.

Services to Remain Functional

While online platforms will be affected, SBI ATMs and branch services will remain fully operational. Customers can continue to perform cash withdrawals, deposits, and other branch-based transactions without disruption.

In addition, UPI payments through third-party apps such as Google Pay, PhonePe, and Paytm are expected to function normally, though some linked services may experience brief delays.

Advice for Customers

SBI has advised its customers to plan their transactions accordingly and use alternative channels such as ATMs or branch banking for urgent requirements. The bank has also urged users to stay updated through official announcements on its website and verified social media handles.

Growing Digital Footprint

SBI’s YONO app and internet banking services cater to millions of customers daily, handling transactions worth several crores. The temporary outage underscores the challenges large financial institutions face in balancing service availability with the need for robust security and system resilience.

This maintenance exercise comes at a time when digital banking adoption in India is witnessing exponential growth, making uninterrupted service a top priority for both banks and customers alike.