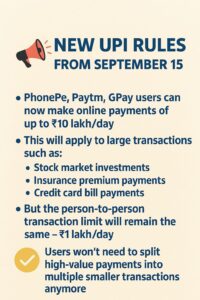

New UPI Rules: Effective from September 15

📢 New UPI Rules: Effective from September 15

Report by: Syed Taskin Ahmed

🔹 What is changing?

The National Payments Corporation of India (NPCI) has announced changes in the Unified Payments Interface (UPI) rules. These changes mainly apply to high-value online transactions.

🔹 When will the new rule take effect?

👉 From September 15, 2025

🔹 Who will be affected?

PhonePe users

Paytm users

Google Pay (GPay) users

And all other UPI-based app users

🔹 What’s the new transaction limit?

For verified merchants, the daily UPI transaction limit will now be ₹10 lakh per day.

This will apply to payments such as:

Stock market investments

Insurance premium payments

Credit card bill payments

Other large online transactions

🔹 What will remain unchanged?

Person-to-person (P2P) transactions will still have the same limit of ₹1 lakh per day.

✅ Direct benefit

Users won’t need to split high-value payments into multiple smaller transactions anymore.